How to update Deputy Custom Fields for Quantaco's Payroll Integration

What Custom Fields are required for Payroll?

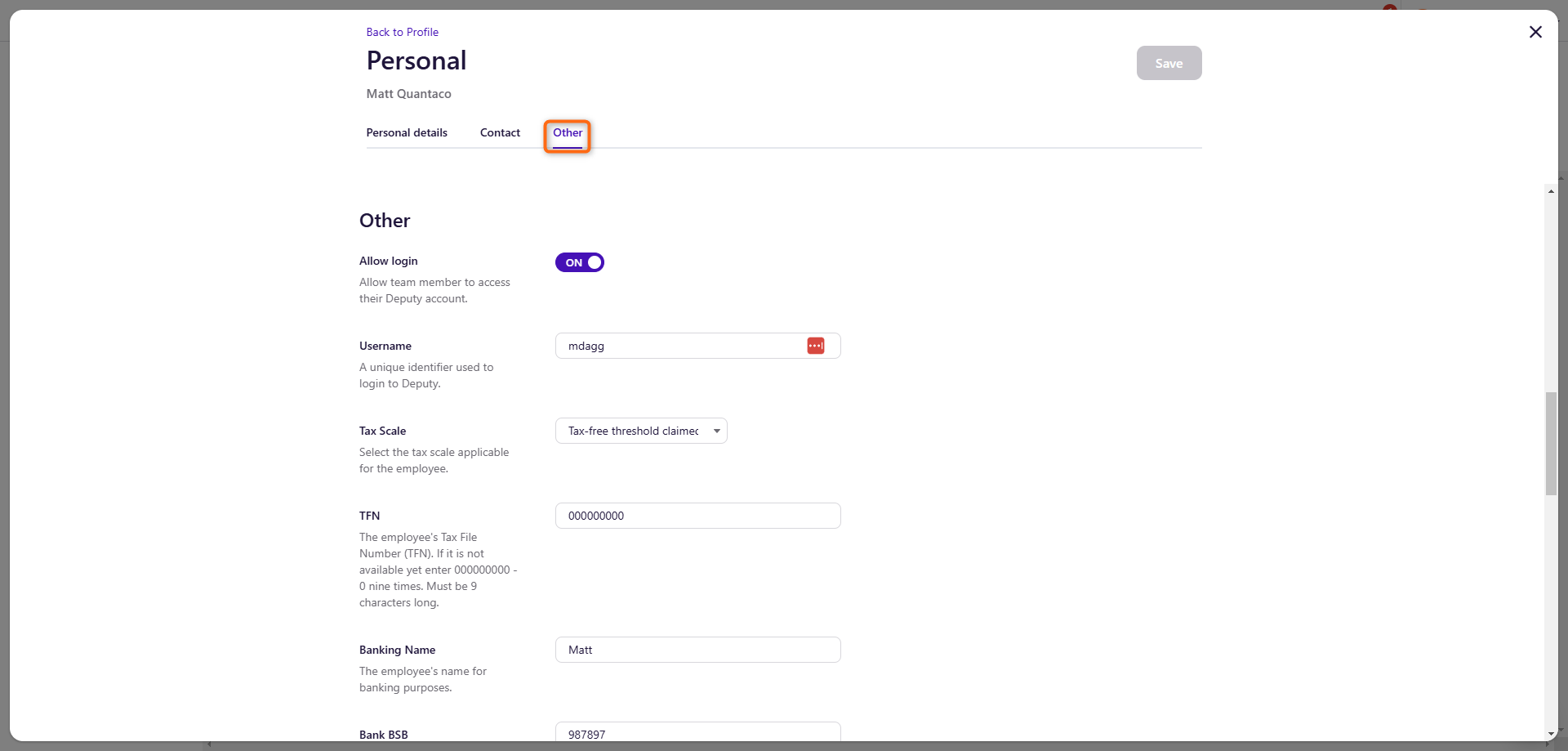

- Tax Scale - Select the tax scale applicable for the employee.

- Tax File Number (TFN) - The employee's tax file number. If it is unavailable enter "000000000"

- Tax Free Threshold Venue - What venue is the employee claiming the tax-free threshold for (applicable if the employee works across multiple venues)

- Bank Account Name - The employee's name associated with the bank account

- Bank BSB - The BSB number for the bank

- Bank Account Number - The Bank account number

- Super Fund - Enter the name of the employee's superannuation fund provider

- Super USI - The USI of the employee's super fund.

- Super Member # - The membership number of the employee's super fund

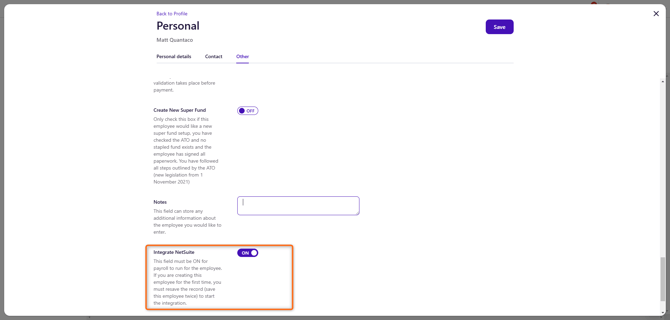

- Create New Super Fund - Toggle this option "ON" if you would like a new super fund setup

How to Update Custom Fields for Integration

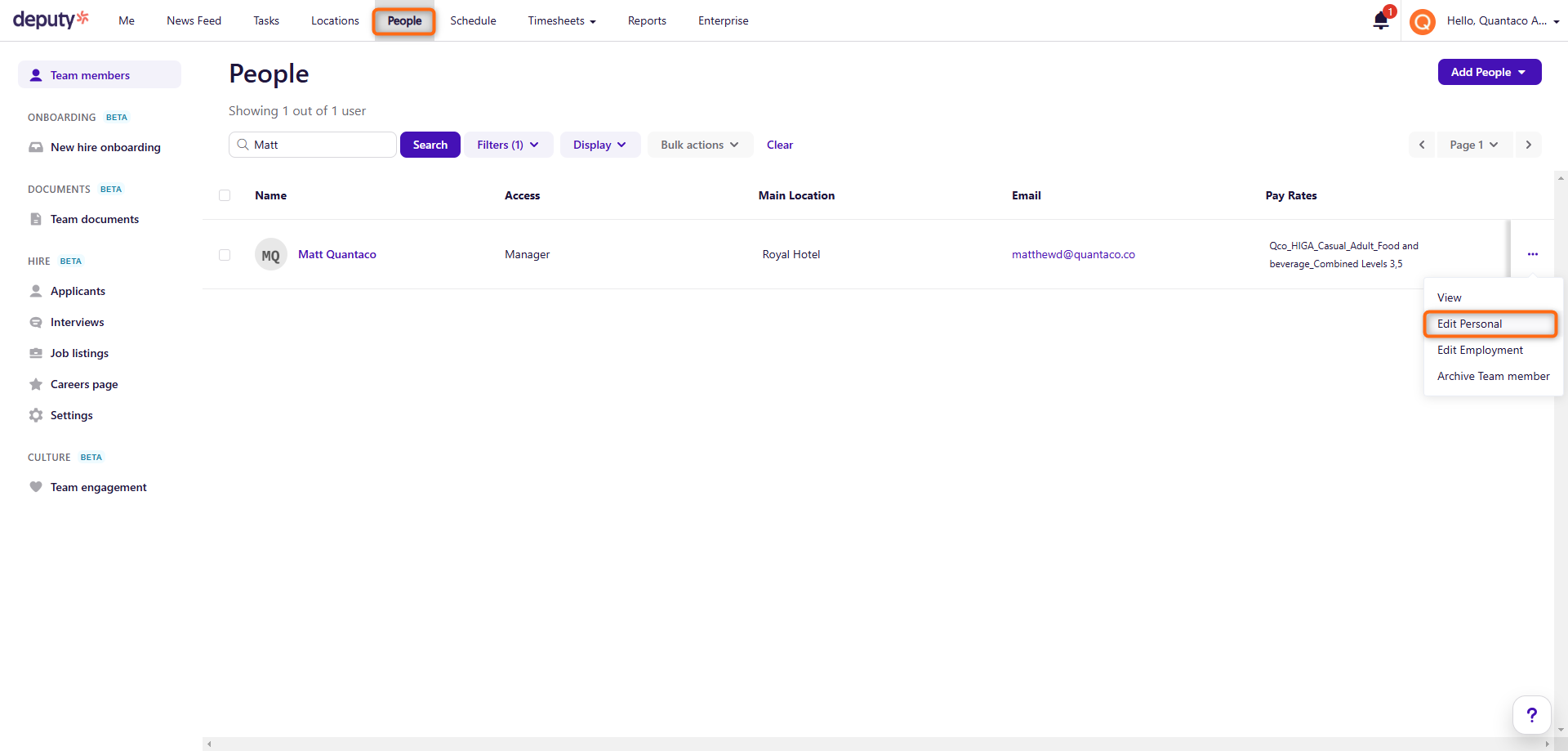

- Edit Personal on the employee that requires updating

- Click "Other Fields"

- Update the required payroll fields

- Toggle Integrate NetSuite to ON

When setting up an employee for the first time, ensure the employee profile is saved with Integrate NetSuite OFF for the first time to ensure the integration is successful.

Frequently Asked Questions (FAQs)

- The NetSuite Integration has an error when saving an employee for the first time

When creating an employee for the first time, save the profile with the Integrate NetSuite toggle as OFF. Then edit the employee again and Integrate NetSuite toggle as ON. - The NetSuite Integration has an error when saving

If an employee exists and their payroll fields need updating, save the profile with the Integrate NetSuite toggle as OFF , update the employee's details and Save.

Then edit the employee for a second time and Integrate NetSuite toggle as ON.

This will resync the payroll integration.